Mean Reversion Strategy Pack

State-of-the-art Python strategies for statistical arbitrage and reversion tradingOverview

This pack delivers 12 unique, research-backed mean reversion strategies for systematic traders and quants. Every strategy comes with Python code, sample backtests, and a clear PDF manual—enabling rapid deployment and adaptation to your workflow.

What’s Inside: Real-World Mean Reversion Engines

- Autoencoder Denoising Residuals: Machine learning-based, finds nonlinear mean reversion trades using autoencoder residuals as anomaly detectors.

- Contrastive-Predictive Coding Reversion: Uses representation learning (CPC) to predict and exploit outlier deviations from learned expectations.

- Dual-Timeframe Z-Score Reversion: Spots overbought/oversold signals using short- and long-term Z-scores for robust multi-horizon reversion.

- Dynamic Bollinger Band Z-Score: Trades reversals at adaptive bands; Z-score levels adjust for volatility.

- Dynamic Kernel Bandwidth Reversion: Nonparametric kernel regression with volatility-adaptive bandwidth for dynamic mean reversion.

- Elastic-Net on Lagged Indicators: Fits a regularized regression on lagged features; trades price deviations from the synthetic mean.

- Gaussian Mixture Cluster-Reversion: Clusters regimes with GMM, trading reversals from extreme price clusters.

- Kalman Filter Fair-Value Reversion: Estimates fair value with a Kalman filter and trades mean reversion to this dynamic equilibrium.

- Kernel Regression Fair-Value: Uses kernel regression to generate a smooth fair value; trades deviations from this mean.

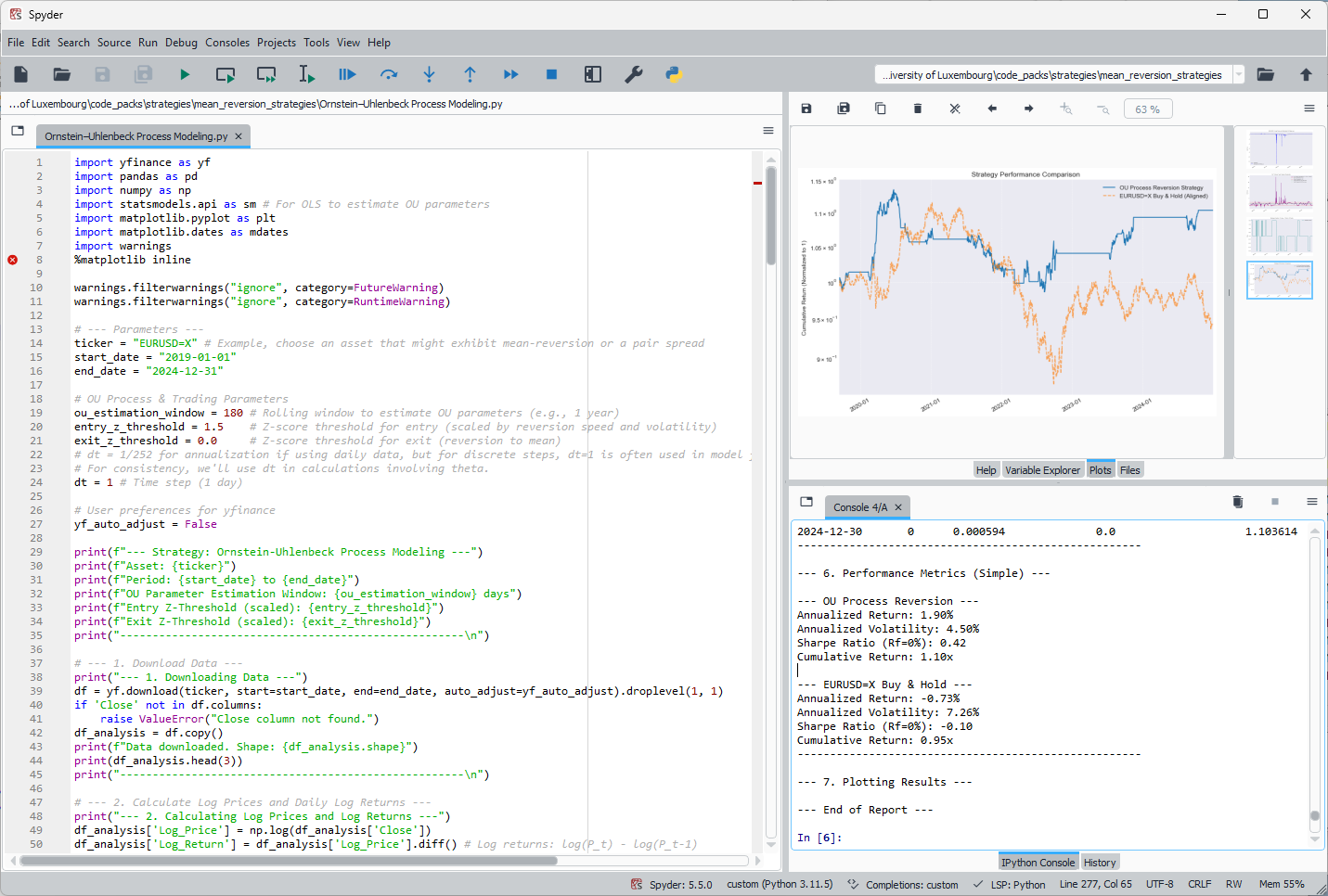

- Ornstein–Uhlenbeck Process Modeling: Classic OU process modeling for mean-reverting spread/statistical arbitrage.

- Quantile-Regression Deviations: Quantile regression finds dynamic thresholds; trades reversals at distribution extremes.

- Volume-Weighted Mean Reversion: Uses price and volume to find and fade moves from the volume-weighted mean.

What You Get

- Full Python source (

.pyformat) - Sample backtests and example configs for each strategy

- PDF manual covering all strategies in detail

How It Works

Import any strategy, plug in your data, set your parameters, and start backtesting or live trading. Compatible with Backtrader and most Python frameworks.

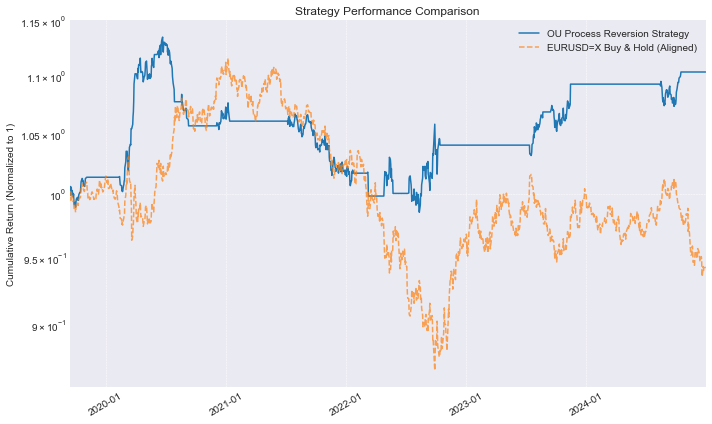

Performance Snapshots

Example results for Ornstein–Uhlenbeck Process Fitting mean reversion strategy with EUR-USD currency pair (actual performance will depend on market, timeframe, and parameters):

- --- OU Process Reversion ---

- Annualized Return: 1.90%

- Annualized Volatility: 4.50%

- Sharpe Ratio (Rf=0%): 0.42

- Cumulative Return: 1.10x

Documentation & Support

- PDF manual for all 12 strategies (download)

- Ongoing code updates and direct email support

Get the Mean Reversion Strategy Pack Now

Download instantly and add institutional-grade mean reversion systems to your workflow. Lifetime updates and direct support included.

Purchase Now!